Charts of the day:

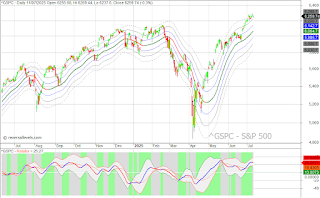

* 357 stocks in bullish mode. Significant downtick and at risk of dropping below the weekly bullish% (332), which would be bearish. * BullsPower at 46, BearsPower at 10. Bulls keep the upper hand. * Above both Watershed lines = bullish. The dW at 6118 is a first line of defense. * The number of pP signals falls back, but stays above 10% for now. A peak is probably in for this indicator.

* ELC goes up. * THRUST goes down. Thrust has not been below zero since the April lows. * The Repellor is at 6073. * BlueSnake keeps pushing higher, but we see some slowing.

* Rotator turns down, mainly because of green component weakness. * The Bands are rising. * Trading still continues in the upper range of the Bands. That's bullish, but with the rotator down it is a time to become more cautious.

* SwX stays yellow - neutral. * MoM goes down from a +8 peak. * We see a gradual weakening in this chart. * The 6200 level (blue line) is support to watch. If it breaks then I expect to see a more severe downside reaction.

* Icebergs algo.

* Both the lava and the gold on the mountain has stopped. That suggests some kind of top is in.

* Green mountain is still above +4, but not by much.

No comments:

Post a Comment